Oh, when will I learn this principle?

I am 54 years old and still fall short in its true application. Something is happening to me when I must act: Freeze!!!

The opportunity comes and goes and we are still thinking about whether we must ride or fold. What is a good exit? Is there any Objective rule?

I can remain in my position for little more than I can expect. I am assessing whether it is good to enter one as a new transaction, and it looks based on mere technicals – YES!

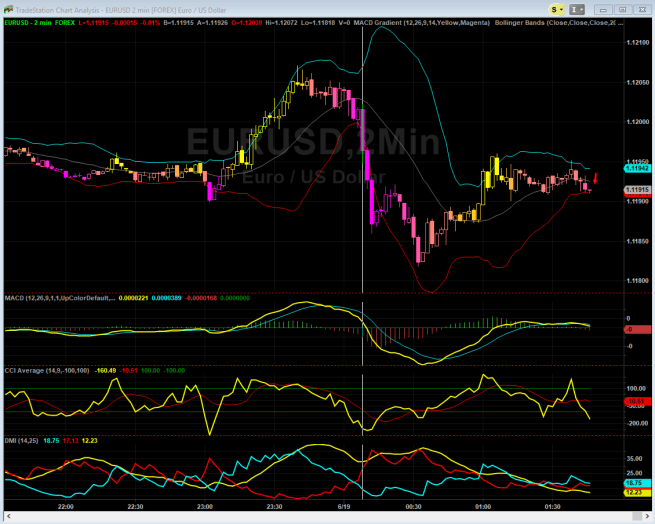

I am short the EURUSD at 1.11961 – The KC is getting narrow and the breakout more possible. My only regret is the time I spent sitting in this position; about 8 hours in total – not worth the time.

In less than ten minutes the position is moving against me and I am still waiting, though knowing very well it is time to exit, I can be wrong like always.

My mind is seeking “Just a Fresh Restart” mechanism so I can adjust my outlook and reassess. As I am typing the position has reversed to my side and is now in the green.

The Market does not know I exist. What is the Market after all, but a bunch of Traders of different sizes and shapes, all in it for a profit, some in pure money terms and others in policy and indirect usage of the currency?

Now I am in the negative. The Trend is your Friend!!!

3 hours later and we have gyrated so many times from losses of $433 to gains of $186 which tells me that there is no damn Trend and Volatility is your mistress.

I learned – but what is the point if I spend my days learning and never applying my learned knowledge {as I write my position turned green with a gain of $281} – I turning over to check the possibility to hold or fold.

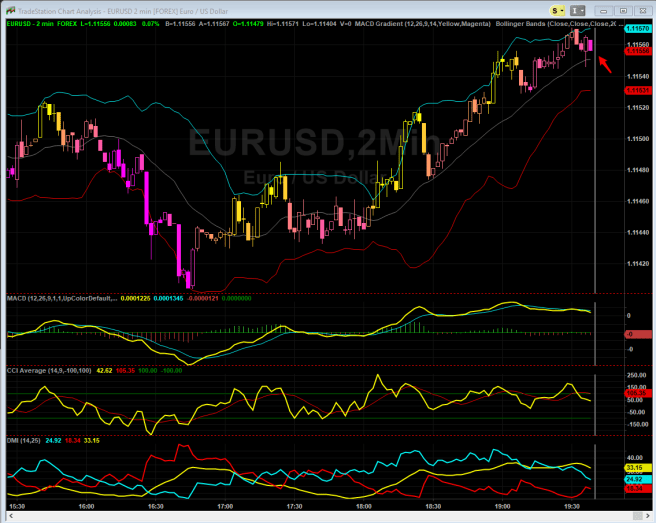

The US Forex market is open now.

I closed my position at a 12 hours marathon for a mere $378 and I reversed my standing based on the Oversold CCI signal – not holding the upside for more than 10 pips.

I am trying to stick to a trading routine of 16 trades per 24 hours for as my back-testing proved albeit with 25% error I already accounted for an $750 secured gain, based on $200,000 lot for the average margin of $4200 with remaining capital on the side of $6000.

I am using the 2/4/15 and 20 minutes charts with slight differences in the indicators and also the 50/100 tick as the moves require.

7:18 AM

Still in gyration but I have to leave and it is not trending so whatever the decision is we must stick to it – let’s see {something is telling me that I will leave it unattended without stop loss} WHY?

10:01 AM

Lost my position as I was driving my son to school. In the red $500 not putting a stop loss and getting angry with myself.

7:30 PM

After a long day of hesitation and doing things to keep my mind away from the position, plus failing drastically to put my mind to work at my day job, I slept a couple of hours and here I am awaiting the opening of the European market. The position is still in the red but has recovered from $800 to $500 loss and the charts are promising.

My downside was the misuse of the capital to sit on a trade that is obviously a losing one. I am so unhappy with my actions and this is where we all lose money. More relaxed and upbeat, I am concentrating on the position and trying to read into it on the short term basis and the long-term as well.

10:15 PM

Soon the Frankfurt market will open and we will see some movement in the damn EURUSD.